Who is a Full Charge Bookkeeper? Roles and Responsibilities

Full charge bookkeeper responsibilities include going much deeper into the general ledger than a regular bookkeeper. Journal entries are prepared and entered by the full charge bookkeeper for accounts such as fixed assets and depreciation. At the end of each month, a trial balance is run to verify that general ledger accounts are in balance. For small businesses and startups, navigating the intricate world of finance can feel daunting. With limited resources, they often need help handling accounting in-house or seeking external support. This is where the full-charge bookkeeper emerges as a vital financial guardian, wielding a multifaceted skillset to keep the financial gears turning smoothly.

What Is Full-Charge Bookkeeping?

- For small businesses and startups, navigating the intricate world of finance can feel daunting.

- A full charge bookkeeper is often more efficient and experienced in handling financial tasks, which can lead to increased productivity and reduced errors.

- He or she might also work alone in the processing of an organization’s financial reporting or basic bookkeeping.

- To reconcile bank statements effectively, you need to carefully review each transaction, match them with corresponding records, and investigate any discrepancies.

- They are responsible for managing all the financial records of a business, from entering invoices for payment, to creating financial reports at the end of the year.

This process requires meticulous attention to detail, as even minor mistakes may lead to significant discrepancies in financial reporting. Many businesses find value in outsourcing bookkeeping services, particularly when it comes to employing full charge bookkeepers. This strategy can significantly cut costs, as it allows firms to benefit from expert financial management without the expense of maintaining a full-time, in-house accounting department. Outsourcing provides access to bookkeepers who can offer a higher level of service, often at a fraction of the cost of a full-time employee. A Full Charge Bookkeeper is a professional managing all the financial records like tax returns or financial statement preparation of small or mid-sized companies.

Conducting Financial Analysis

This may involve staying late or working on weekends to meet deadlines and ensure the smooth operation of the financial department. While not mandatory, obtaining a certification in bookkeeping or accounting can significantly enhance a full charge bookkeeper’s qualifications. Certifications such as Certified Bookkeeper (CB) or Certified Public Bookkeeper (CPB) demonstrate a bookkeeper’s expertise and commitment to professional development. As a full charge bookkeeper, there are certain experience and qualifications that are essential to excel in this role. Let’s take a closer look at each of these requirements to understand what it takes to become a proficient full charge bookkeeper. Problem-solving abilities are essential for a full charge bookkeeper to navigate through complex financial situations.

Looking for a job? Prepare for interviews here!

They generate financial reports and statements, permitting business owners to make informed alternatives based on accurate financial data. An in-house bookkeeper may not be involved in higher-degree financial evaluation or decision-making. A Full Charge Bookkeeper is an individual responsible for managing a company’s financial records, including accounts payable and accounts receivable, https://www.bookstime.com/ billing, and payroll. They ensure accurate record-keeping and compliance with accounting regulations and financial best practices. They process employee timesheets, run payroll checks and prepare monthly and quarterly tax returns. A full charge bookkeeper typically handles all of a company’s banking needs, including reconciling monthly bank statements and monitoring cash flow.

B. Produce Financial Statements and Reports:

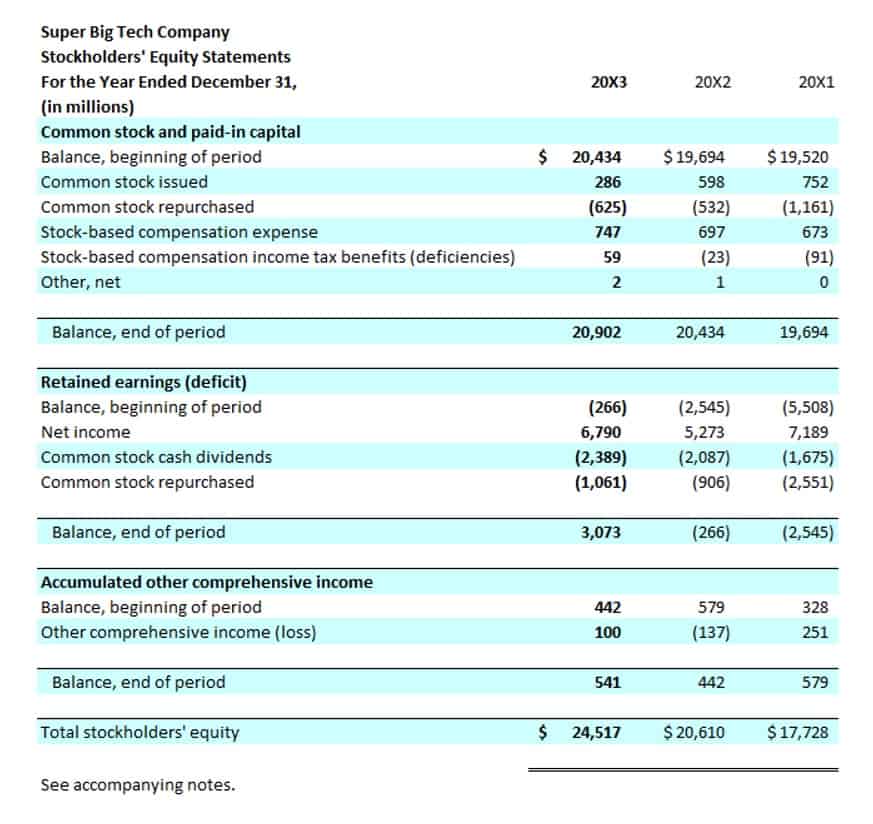

Full Charge Bookkeepers are responsible for preparing financial statements, including balance sheets, income statements, and cash flow statements. These documents provide a snapshot of the company’s financial status and are essential for strategic planning and decision-making. This process involves comparing the company’s recorded transactions with the bank’s records to ensure accuracy and identify any discrepancies. By regularly reconciling bank statements, you can detect errors, prevent fraudulent activity, and maintain the integrity of the financial records.

E-Commerce Innovations to Implement in Your Business Right Now

Knowing the regulation standards means full charge bookkeepers can help the business stay in compliance. These full service bookkeeping duties could include data entry of accounts payable invoices and preparing bank deposits. Generating accurate and timely financial statements is vital for decision-making, financial planning, and complying with legal and regulatory requirements. It requires a strong understanding of accounting principles, attention to detail, and proficiency in accounting software. Additionally, students will also learn how to use accounting software and other tools that are commonly used in bookkeeping.

- EcomBalance also has a sister company, AccountsBalance, that caters to agencies, software companies, coaches, and other online companies.

- In the office environment, you will have a designated workspace equipped with a computer, accounting software, and other necessary tools.

- In summary, full-charge bookkeeping encompasses a wide array of responsibilities that impact not only financial record-keeping but also the overall success of a company.

- We believe that diversity and inclusion are key to building a strong and successful team.

- They can also help you develop budgets, track cash flow, and provide valuable insights into your financial performance.

- As a full charge bookkeeper, there are several essential skills that you need to possess in order to effectively perform your duties.

While both play crucial roles in financial management, there’s a distinct difference between a full-charge bookkeeper and a Certified Public Accountant (CPA). CPAs hold higher accounting expertise and are authorized to perform specialized tasks like audits, tax planning, and consulting. Even the smallest error or omission in financial data can have significant consequences for a business.

Full-charge bookkeepers‘ educational background and training requirements can vary depending on the business and the organization’s specific needs. While a formal degree in accounting or finance can be positive, becoming a full-charge bookkeeper isn’t always a strict requirement. Full-charge bookkeepers gather their skills through a combination of education, on-the-job training, and professional what is a full charge bookkeeper certifications. While regular bookkeepers handle daily tasks under supervision, full-charge bookkeepers often operate independently, taking on additional accounting duties that affect the company’s bottom line. They have a more comprehensive understanding of the bookkeeping role, allowing them to support or even lead the current bookkeeping staff with less experienced members.