The LIFO Method for Cost of Goods Sold

COGS is not addressed in any detail in generally accepted accounting principles (GAAP), but COGS is defined as only the cost of inventory items sold during a given period. Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on a company’s income statement, no deduction can be applied for those costs.

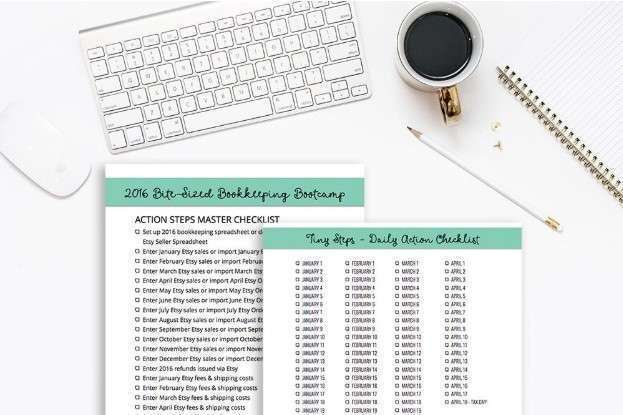

What method of inventory management should you use?

The products that are left in the warehouse are called remaining inventory. As you can see, a lot of different factors can affect the cost of goods sold definition and how it’s calculated. The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. If the manufacturing plant were to sell 10 units, under the LIFO method it would be assumed that part of the most recently produced inventory from Batch 2 was sold.

LIFO Calculator for Inventory

- LIFO stands for last-in, first-out, and it’s an accounting method for measuring the COGS (costs of goods sold) based on inventory prices.

- This method of inventory valuation is widely used as it is simple to use.

- QuickBooks allows you to use several inventory costing methods, and you can print reports to see the impact of labor, freight, insurance, and other costs.

- If you don’t have an ending inventory, it means all products started during the period were completed, and your ending WIP inventory would be zero.

- For FIFO, higher gross income and profits may look more appealing to investors, but it will also result in a higher tax bill.

- When Jordan opened the business, he decided that LIFO made the most sense.

This formula is most effective when inventory constitutes the majority of your COGS. For service-based businesses or those with high labor needs, calculating the cost may require you to include additional factors. You can save all this time to calculate manually, though, if you are using online accounting software like Deskera.

Download the Free LIFO Calculator Template

To answer this, let’s see how a business like yours might be managing goods & inventory in real life. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. FIFO is the more straightforward method to use, and most businesses stick with the FIFO method.

The ideal selling price should be at least greater than $7 to make a profit since it needs to account for both COGS and the additional indirect costs like marketing and shipping. In both cases, only goods actually sold are included in the calculations. This means that if you purchased a batch of 300 goods and only sold 150, you would multiply the purchase price by 150. The most significant difference between FIFO and LIFO is its impact on reported income and profits. For FIFO, higher gross income and profits may look more appealing to investors, but it will also result in a higher tax bill.

Instead of selling its oldest inventory first, companies that use the LIFO method sell its newest inventory first. Examples of pure service companies include accounting firms, law offices, real estate appraisers, lifo cogs formula business consultants, and professional dancers, among others. Even though all of these industries have business expenses and normally spend money to provide their services, they do not list COGS.

Under LIFO, remaining inventory may not be a reflection of market value. This is because older inventory was often purchased at a lower price and the market may have changed since the early orders. After the January 10 sale, we still have 150 units from the second layer and it is enough to cover the January 15 sale of 120 units. As of January 15, we still have 30 units from beginning inventory and 30 units from the January 5 purchase. In a periodic inventory system, you only update the inventory account at the end of the period, such as monthly, semiannually, or annually, after a physical inventory count.

LIFO Calculator

Accordingly, in FIFO method of inventory valuation, goods purchased recently form a part of the closing inventory. Now, in order to better understand the FIFO method, let’s consider the example of Harbour Manufacturers. That is, this method of inventory management records the sale and purchase of inventory thus providing a detailed record of the changes in the inventory levels. This is because the inventory is immediately reported with the help of management software and an accurate amount of inventory in stock as well as on hand is reflected. In addition to the above mentioned costs, there might be other costs including marketing, travelling, administrative, and selling expenses.

- Under the matching principle of accrual accounting, each cost must be recognized in the same period as when the revenue was earned.

- For example, if you are a manufacturing company, you may want to invest in machinery that can automate some of the production processes.

- In addition, many companies will state that they use the „lower of cost or market“ when valuing inventory.

- After the January 10 sale, we still have 150 units from the second layer and it is enough to cover the January 15 sale of 120 units.

- However, International Financial Reporting Standards (IFRS) permits firms to use FIFO, but not LIFO.

Last In, First Out (LIFO): The Inventory Cost Method Explained

All costs are posted to the cost of goods sold account, and ending inventory has a zero balance. It no longer matters when a particular item is posted to the cost of goods sold account since all of the items are sold. FIFO and LIFO produce a different cost per unit sold, and the difference impacts both the balance sheet (inventory account) and the income statement (cost of goods sold). One downside to using the LIFO method is that older inventory may continue to sit in the warehouse unless the business sells all of its newer inventory. For goods that decay over time, like perishable items or trend-based goods, this can mean that the remaining inventory loses value.

How to calculate the cost of goods manufactured

When you compare the cost of goods sold using the LIFO calculator, you see that COGS increases when the prices of acquired items rise. Such a situation will reduce the profits on which the company pays taxes. LIFO reserve is an accounting term that measures the difference between the first in, first out (FIFO) and last in, first out (LIFO) cost of inventory for bookkeeping purposes. Cost of Goods Sold (COGS) calculates the total cost incurred in getting the product ready for sale in the market. However, COGS doesn’t include all the costs incurred while running the business. It mainly comprises direct expenses incurred in making the finished product or getting it to your customer.