Post-Closing Trial Balance Financial Accounting

Its purpose is to test the equality between debits and credits after closing entries are prepared and posted. The post-closing trial balance contains real accounts only since all nominal accounts have already been closed at this stage. A post-closing trial balance is a list of balance sheet accounts with net-zero balances at the end of the reporting period.

- Unlike the usual Trial balance, there are no unadjusted or adjusted variations, it’s all done in one go.

- Notice the middle column lists the balance of the accounts with a debit balance, while the right column has balances for credits.

- This makes sure the company is ready for the new accounting year.

- It is also the basis in preparing the financial statements.

- Before that, it had a credit balance of 9,850 as seen in the adjusted trial balance above.

Hire An Accountant At The Most Affordable Prices

A net-zero indicates that all temporary accounts are closed with zero beginning balance so the next accounting period can begin. Moving from the adjusted to the post-closing trial balance finishes the accounting period. This includes revenue, expense, owner’s drawing accounts, and the Income Summary account.

How is the Post-Closing Trial Balance relevant to companies listed on the NYSE or NASDAQ?

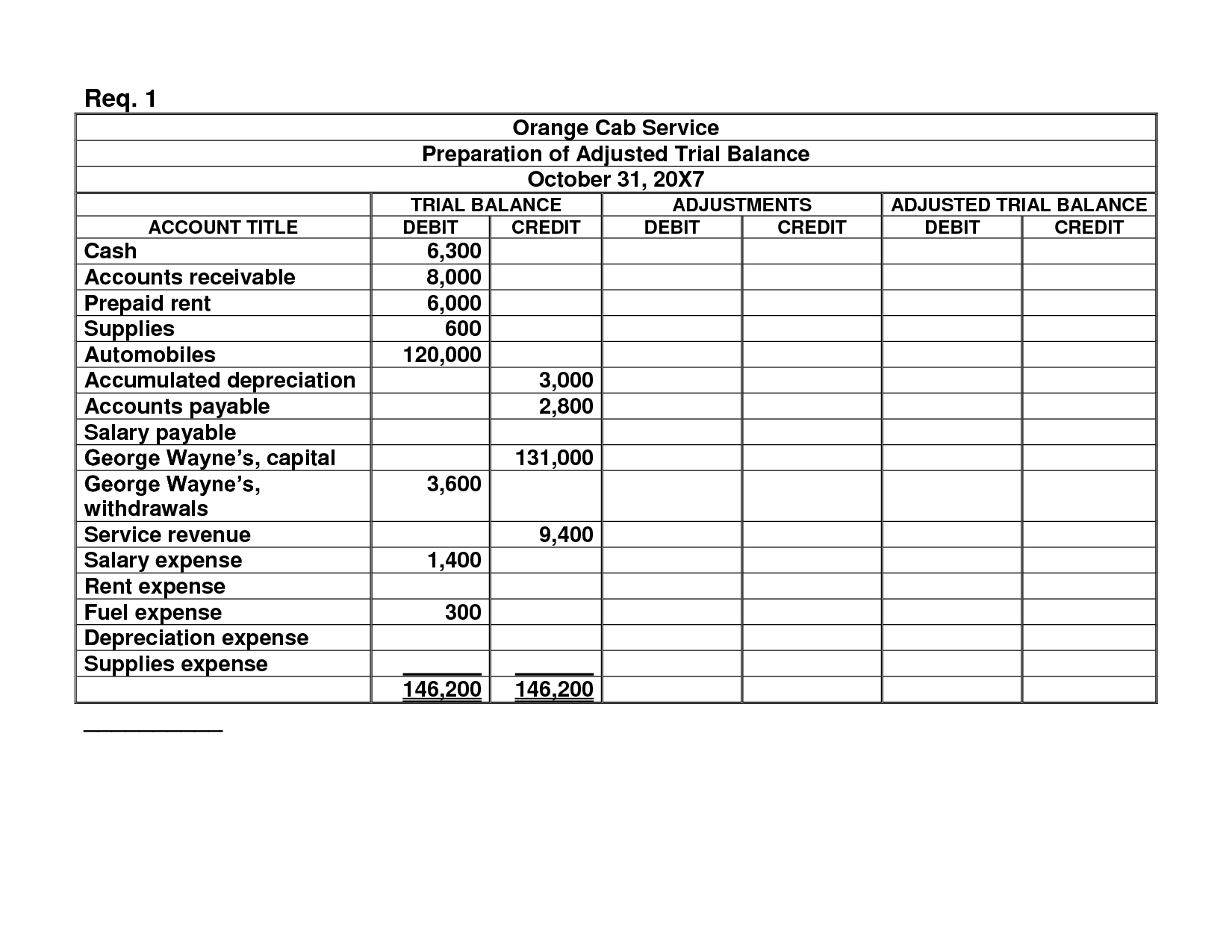

They are an unadjusted trial balance, adjusted trial balance, and post-closing trial balance. All of the above tests whether all debits equal all credits. Also, it determines whether any balances are remaining in the permanent accounts after closing entries have been journalized.

Comparing Pre-Closing and Post-Closing Trial Balances: Key Differences

Each entry shapes the company’s story, from day-to-day to big decisions. It helps avoid 60% of common errors, building trust and a solid reputation. At year-end, these accounts move their totals to the shareholders’ equity. This is done on the balance sheet, where accounts are permanent.

Closing Entries and Their Impact on Financial Statements

By verifying the equality of debits and credits, the post-closing trial balance confirms that the accounts are ready for the next accounting period. It is used to verify that the total of all debit balances equals the total of all credit balances, which should be net to zero. This accounts list is identical to the accounts presented on the balance sheet. This makes sense because all of the income statement accounts have been closed and no longer have a current balance.

Note that while a trial balance is helpful in the double-entry system as an initial check of account balances, it won’t catch every accounting error. The trial balance is a mathematical proof test to make sure that debits and credits are equal. And just like any other trial balance, total debits and total credits should be equal. And finally, in the fourth entry the drawing account is closed to the capital account. At this point, the balance of the capital account would be 7,260 (13,200 credit balance, plus 1,060 credited in the third closing entry, and minus 7,000 debited in the fourth entry). This is a sort of Trial balance conducted when the financial period is already closed.

After adjusting entries, you can prepare closing entries to complete the post-closing trial balance. Closing temporary accounts is a crucial step in the accounting cycle that helps to make sure the post-closing trial balance has been completed accurately. A post-closing trial balance is a financial report that lists all the accounts with their updated balances after the closing entries have been made at the end of an accounting period. A trial balance is an accounting report that lists the ending balances of general ledger accounts to ensure the debit and credit balances are equal.

However, all the other accounts having non-negative balances are listed including the retained earnings account. The post-closing trial balance plays a key role in the accounting world. It ends the accounting cycle, showing a company’s financial status clearly. Done monthly or yearly, it makes sure financial reports are right on point. They close revenue and expense accounts, adjust Income Summary and Dividends, and set temporary account balances to zero. This updates permanent account balances like retained earnings.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The fiscal health of net working capital definition a nation and its companies are linked. If a country expects higher debt-to-GDP ratios, companies might face tougher rules. This could change how they manage their money and affect investor profits.

Usually, the Post-closing trial balance is compiled some time after the period has finished practically. Business owners and managers use Post Closing Trial Balances for various analysis purposes, planning and budgeting. They can also use such reports to compute financial ratios. Financial ratios are mathematical formulas that provide business owners and managers with indicators to measure against a competing company or industry standard. Financial ratios are a performance management technique using accounting information.