Contribution Margin Formula with Calculator

Let us try to understand the concept with a contribution margin example. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. One common misconception pertains to the difference between the CM and the gross margin (GM).

How to Conduct an Accounts Payable Audit: What You Should Know

The formula to calculate the contribution margin ratio (or CM ratio) is as follows. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months increase manufacturing capacity in times of crisis with lean principles of April and May. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference. A university van will hold eight passengers, at a cost of \(\$200\) per van.

- The company will use this “margin” to cover fixed expenses and hopefully to provide a profit.

- However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin.

- The following are the disadvantages of the contribution margin analysis.

- The contribution margin ratio (CMR) expresses the contribution margin as a percentage of revenues.

How confident are you in your long term financial plan?

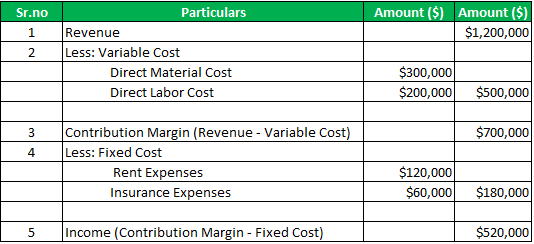

Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs. For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify the increase in fixed costs. This assessment ensures investments contribute positively to the company’s financial health. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit. To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue.

Contribution Margin: What it is and How to Calculate it

There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10).

A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. Decisions can be taken regarding new product launch or to discontinue the production and sale of goods that are no longer profitable or has lost its importance in the market. The $30.00 represents the earnings remaining after deducting variable costs (and is left over to cover fixed costs and more). The resulting ratio compares the contribution margin per unit to the selling price of each unit to understand the specific costs of a particular product.

How can a business increase its Contribution Margin Ratio?

A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable.

Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio.

Thus, Dobson Books Company suffered a loss of $30,000 during the previous year. Furthermore, a higher contribution margin ratio means higher profits. This means that you can reduce your selling price to $12 and still cover your fixed and variable costs.

You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin.

Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. In accounting, contribution margin is the difference between the revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product.

This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances. If the annual volume of Product A is 200,000 units, Product A sales revenue is $1,600,000. To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis.