Contra Accounts: Definition, Types, Example The Motley Fool

The main advantage of using a contra asset account is to separate this reduction from the asset account with which it is paired. By doing so, you can more clearly see the total amount of the related asset account, which would otherwise have been obscured by the offsetting amount of the reserve. At Invoiced, we provide a suite of solutions that work together to make managing your invoicing, accounts receivable, and accounts payable seamless and easy. To convert your invoice management efforts to an electronic format that can easily share data with other financial systems, businesses can leverage Invoiced’s E-invoice Network. At the same time, our Accounts Receivable Automation software and Accounts Payable Automation software makes tracking, managing, and processing crucial assets and liabilities — and their contras — easier than ever before. In its general ledger, the business will want to capture its gross sales figures and the actual value of the discount.

Income Statement Method for Calculating Bad Debt Expenses

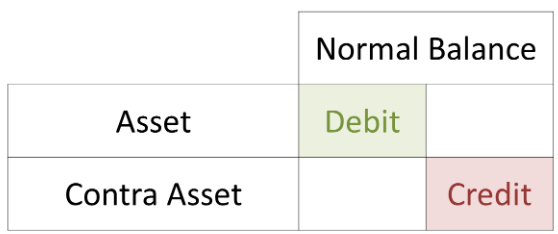

This placement ensures that the net value of each asset is clearly displayed. Contra asset account is an important element of the balance sheet or the books of accounts. This is because it tallies two respective debit-credit entry pairs, thereby figuring out the net balance of the asset account.

Why Do Accountants Use Allowance for Doubtful Accounts?

A contra asset is not a separate type of asset but rather an account that reduces the value of a related asset. It is used to offset the cost of long-term assets on the balance sheet and provide a more accurate representation of their current value. where do contra assets go on a balance sheet It offsets the value of a long-term asset and reflects its wear and tear or obsolescence. Accumulated depreciation, which represents the total depreciation over time, is recorded as a contra asset and reduces the carrying value of the related asset.

What Is a Contra Account?

- The direct write-off method delays recognitionof bad debt until the specific customer accounts receivable isidentified.

- Then, current and fixed assets are subtotaled and finally totaled together.

- So, an organization looking for a robust accounting process must move to this reporting for better understanding.

- You’ll notice that because of this, the allowance for doubtful accounts increases.

- A balance sheet must always balance; therefore, this equation should always be true.

Bad Debt Expense increases (debit) as does Allowance forDoubtful Accounts (credit) for $58,097. Rather than pay this cost up-front and tie up a significant chunk of capital, Show-Fleur makes this purchase on credit with a 90-day due date after invoicing. Fortunately, the seat vendor offered an early payment discount of 5%, meaning that when Show-Fleur paid off its full credit note within the first 30 days, it recouped $30 thousand in savings. A business called Show-Fleur offers private driving tours of local botanical gardens — all from the comfort of high-end limousines. For its day-to-day operations, the business maintains a fleet of 75 identical 2016 Ford Explorer limousines, each initially retailing at $150 thousand. However, these vehicles have experienced significant wear and tear in the intervening years.

The Language of Business

Because the allowance for doubtful accounts is established in the same accounting period as the original sale, an entity does not know for certain which exact receivables will be paid and which will default. Therefore, generally accepted accounting principles (GAAP) dictate that the allowance must be established in the same accounting period as the sale, but can be based on an anticipated or estimated figure. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. They represent the compensation paid to employees for their work and are typically recognized in the income statement. Salaries are a significant cost for many companies and need to be carefully managed to ensure profitability and financial stability. It represents an advance payment made for goods or services that will be received in the future.

Heating and Air Company

Properly documenting these contra accounts in your ledger can sometimes feel counter-intuitive since they operate in an opposite manner from their parent accounts. Consider an asset account, where the values are listed as debits, and the account itself will present a positive total. Conversely, for a contra asset account like depreciation, you would list all entries as a credit, carrying a negative total balance for the overall account. In QuickBooks, managing contra asset accounts involves creating a new account in the chart of accounts with the type designated as a fixed asset or other current asset, depending on the nature of the contra account.

When the account receivable is written off, it is added to bad debt expense on the income statement and placed in the contra account. If a company has a high or fast-growing allowance as a percentage of accounts receivable, keep a close eye on it. Most accountants choose to record the depreciation over the useful life of an item in the accumulated depreciation contra asset account, which is a credit account. The balance sheet would show the piece of equipment at its historical cost, then subtract the accumulated depreciation to reflect the accurate value of the asset.

It is actually an expense that represents the uncollectible portion of accounts receivable. Bad debt expense is recorded to reflect the potential losses a company may incur when customers fail to pay their debts. The balance sheet method (also known as thepercentage of accounts receivable method) estimates bad debtexpenses based on the balance in accounts receivable. The balance sheet method isanother simple method for calculating bad debt, but it too does notconsider how long a debt has been outstanding and the role thatplays in debt recovery. In simple terms, a contra asset is an account that offsets the value of a related asset on a company’s balance sheet. It represents the reduction of an asset’s value or an allowance for potential losses.

The Allowance for Doubtful Accounts represents a contra asset account that reduces accounts receivable. This account estimates the portion of receivables that a company believes will not be collected, indicating a more accurate value of potential revenue. As you saw in the example, contra accounts can be an important part of your financial statement analysis, but they are hard to find. Companies bury them in the footnotes and often don’t break out the actual calculation.