Accounts Payable Turnover Ratio: What It Is, How To Calculate and Improve It

Measured over time, a decreasing figure for the AP turnover ratio indicates that a company is taking longer to pay off its suppliers than in previous periods. Alternatively, a decreasing ratio could also mean the company has negotiated different payment arrangements with its suppliers. The AP turnover ratio primarily reflects short-term financial practices and may not be indicative of long-term financial stability or operational efficiency. A company might have a favorable ratio in the short term due to aggressive payment practices but face long-term sustainability issues.

Cash Flow Misinterpretation

A low AP turnover ratio could indicate that a company is in financial distress or having difficulty paying off accounts. But, it could also indicate that a business is making strategic financial decisions about upfront investments that will pay off later. In conclusion, mastering the Accounts Payable Turnover Ratio is not just about crunching numbers; it’s about gaining valuable insights into your company’s financial health and operational efficiency. In today’s digital era, leveraging technology can significantly enhance your accounts payable processes and positively impact your AP turnover ratio.

- For businesses with seasonal sales patterns, such as retail or agriculture, the AP turnover can fluctuate significantly throughout the year.

- How does the accounts payable turnover ratio relate to optimizing cash flow management, external financing, and pursuing justified growth opportunities requiring cash?

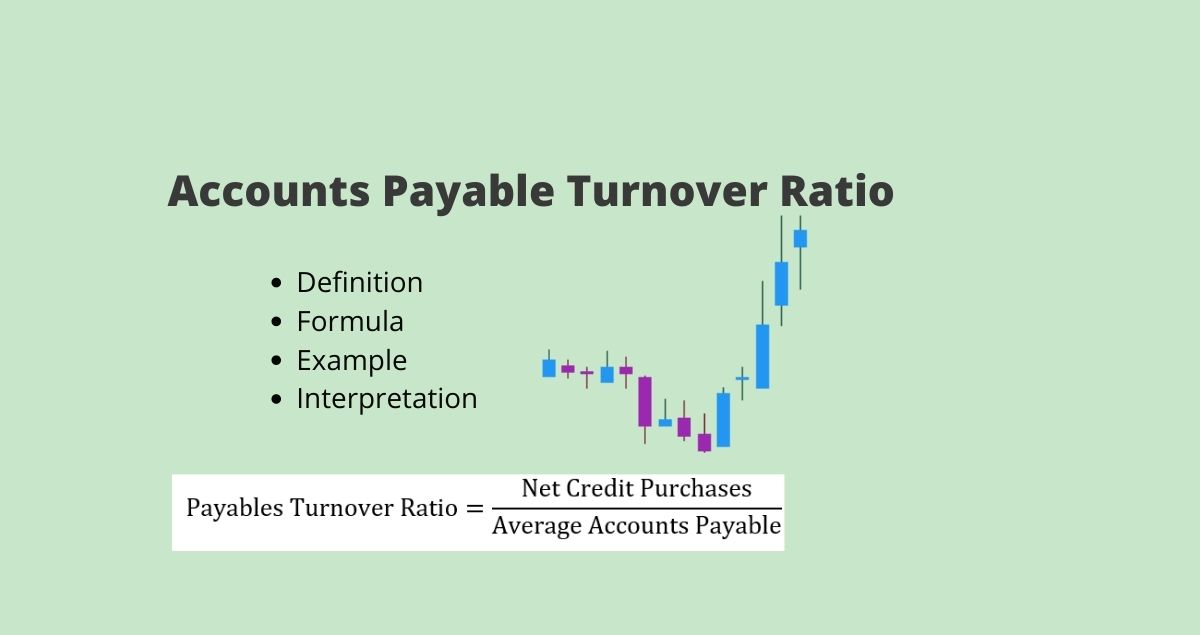

- It provides important insights into the frequency or rate with which a company settles its accounts payable during a particular period, usually a year.

- This can indicate that the company is managing its debts and cash flow effectively.

- While both are turnover ratios, each reveals a different aspect of business operations.

What is the average payable turnover ratio?

It provides insights into liquidity, working capital management, and the company’s ability to meet its financial obligations. A higher ratio shows suppliers and creditors that the company pays its bills frequently and regularly. A high turnover ratio can be used to negotiate favorable credit terms in the future.

Importance of Your Accounts Payable Turnover Ratio

Both ratios provide valuable insights into a company’s financial health and, when used together, offer a more comprehensive view. To balance cash inflows and outflows, compare your accounts what are accounting advisory services with your accounts receivable turnover ratio. Or apply the calculation comparing the payables turnover in days to the receivables turnover in days if that’s easier for you to understand. While creditors will view a higher accounts payable turnover ratio positively, there are caveats. If a company has a higher ratio during an accounting period than its peers in any given industry, it could be a red flag that it is not managing cash flow as well as the industry average.

What is a good AP to AR ratio?

To see how attractive you will be to funders, match your AP ratio to peers in your industry. This means that Company A paid its suppliers roughly five times in the fiscal year. To know whether this is a high or low ratio, compare it to other companies within the same industry. While measuring this metric once won’t tell you much about your business, measuring it consistently over a period of time can help to pinpoint a decline in payment promptness.

Ways to Lower AP Turnover Ratio

They can take advantage of early payment discounts offered by their vendors when there’s a cost-benefit. Use graphs to view the changes in trends as the economy and your business change. Learning how to calculate your accounts payable turnover ratio is also important, but the metric is useless if you don’t know how to interpret the results.

Although your accounts payable turnover ratio is an important metric, don’t put too much weight on it. Consult with your accountant or bookkeeper to determine how your accounts payable turnover ratio works with other KPIs in your business to form an overall picture of your business’s health. In and of itself, knowing your accounts payable turnover ratio for the past year was 1.46 doesn’t tell you a whole lot. Then, divide the total supplier purchases for the period by the average accounts payable for the period. A higher ratio suggests efficient liquidity management, whereas a lower ratio could indicate potential cash flow challenges needing further investigation. The AP turnover ratio is a valuable tool for analyzing a company’s liquidity and efficiency in managing its payables.

Mosaic also offers customizable templates to create unique dashboards that include the metrics you need to track most. Track invoice status metrics — both amount and count — to keep track of the revenue coming in. Monitor expenses as a percentage of revenue to ensure you’re not overspending in any one area.

Cash purchases are excluded in our computation so make sure to remove them from the total amount of purchases. Another industry that can benefit from a high Accounts Payable Turnover Ratio is the healthcare industry. Healthcare providers need to purchase a large volume of medical supplies and equipment, and they need to pay their suppliers on time to ensure a steady supply of essential items. A high Accounts Payable Turnover Ratio can help healthcare providers negotiate better prices and payment terms with their suppliers, which can ultimately lead to cost savings for patients.