How to Prepare an Accurate Adjusted Trial Balance

The adjustments made, however, are classified into different categories, which include – deferrals, accruals, missing transactions, and tax adjustments. Marketing Consulting Service Inc. adjusts its ledger accounts at the end of each month. The unadjusted trial balance on December 31, 2015, and adjusting entries for the month of December are given below. By providing a snapshot of all ledger accounts within a given accounting period, the trial balance helps business owners and accounting teams in reviewing accuracy.

Unit 4: Completion of the Accounting Cycle

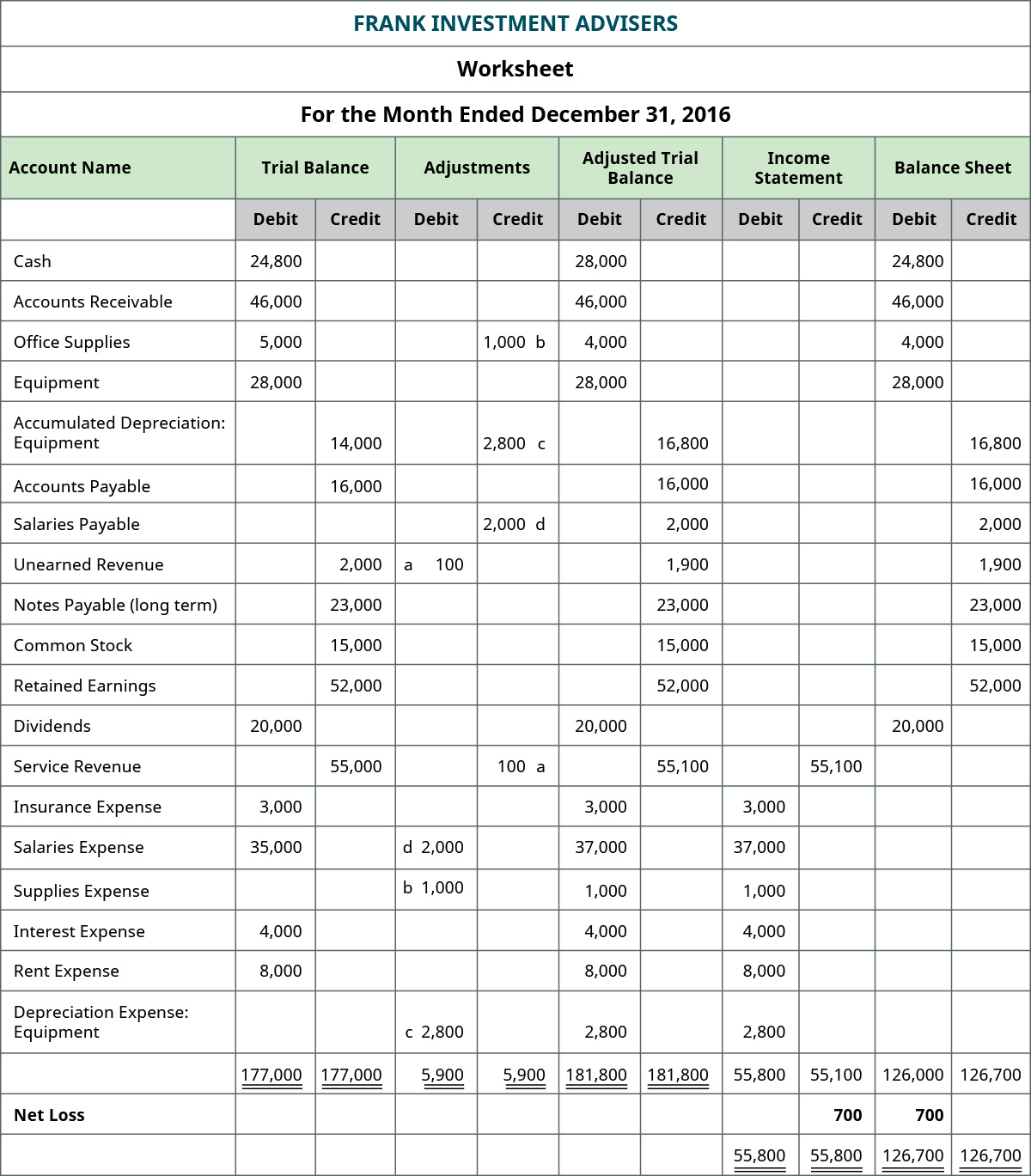

Using Paul’s unadjusted trial balance and his adjusted journal entries, we can prepare the adjusted trial balance. Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced. A trial balance is an internal report that itemizes the closing balance of each of your accounting accounts. It acts as an auditing tool, while a balance sheet is a formal financial statement. The salon had previouslyused cash basis accounting to prepare its financial records but nowconsiders switching to an accrual basis method.

How to Prepare an Adjusted Trial Balance

It arises when an asset is a sale, but the customer has not yet billed for the same. As the name suggests, it includes deductions with respect to the tax liabilities. There are instances when companies end up missing out mentioning the transactions that have occurred in the bookkeeping records. For the past 52 years, Harold Averkamp debtor definition and meaning (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

First method – inclusion of adjusting entries into ledger accounts:

However, it is the source document if you are manually compiling financial statements. In the latter case, the adjusted trial balance is critically important – financial statements cannot be constructed without it. Note that while a trial balance is helpful in the double-entry system as an initial check of account balances, it won’t catch every accounting error. The trial balance is a mathematical proof test to make sure that debits and credits are equal. Accrued revenues are revenues earned, but not received in monetary terms, and therefore represent receivables. An adjusted trial balance can also refer to a trial balance where the account balances are adjusted by the external auditors.

- Using Paul’s unadjusted trial balance and his adjusted journal entries, we can prepare the adjusted trial balance.

- This step updates the individual account balances to reflect the adjustments.

- Both the debit and credit columns are totaled at the bottom and must be equal in order to agree with the accounting equation.

- Budgeting foremployee salaries, revenue expectations, sales prices, expensereductions, and long-term growth strategies are all impacted bywhat is provided on the financial statements.

Its purpose is to test the equality between debits and credits after adjusting entries are made, i.e., after account balances have been updated. Both the debit and credit columns are calculated at the bottom of a trial balance. As with the accounting equation, these debit and credit totals must always be equal. If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately. Adjusted trial balance is not a part of financial statements; rather, it is a statement or source document for internal use. It is mostly helpful in situations where financial statements are manually prepared.

After compiling the necessary data, attention should turn to identifying adjustments. This involves scrutinizing transactions closely to pinpoint those that have not yet been recorded or require modification. For example, adjustments might be needed for accrued revenues that have been earned but not yet recorded, or for expenses that have been incurred but not yet reflected in the accounts.

The final total in thedebit column must be the same dollar amount that is determined inthe final credit column. Once the requisite adjustments have been identified, they should be recorded in the general journal. This process requires precision, ensuring that each adjustment accurately reflects the financial activity it represents. Careful documentation is crucial in this phase, as it underpins the integrity of the adjusted trial balance. Each entry must be precisely recorded to ensure that the accounts involved are correctly updated. There are multiple financial statements that are prepared by the businesses at the end of a financial year.

Unearned revenues, also known as deferred revenues, are payments received before the delivery of goods or services. Initially recorded as liabilities, these amounts require adjustments as the company fulfills its obligations. To adjust for unearned revenues, an entry is made to debit the unearned revenue liability account and credit the appropriate revenue account.