4 2: Describe and Identify the Three Major Components of Product Costs under Job Order Costing Business LibreTexts

Direct materials are raw materials that can be easily and economically traced to the production of the product. Indirect materials are raw materials that cannot be easily and economically traced to the production of the product, e.g. glue, nails, sandpaper, towels, etc. Payroll taxes, including employee payroll taxes such as Social Security and Medicare, are mandatory contributions made by employers. Together with benefits paid, these elements represent indirect costs that must be accounted for when determining standard direct labor cost. Like direct labor, a significant part of total indirect labor cost consists of fringe benefits, employer’s contributions and payroll taxes etc. Indirect labor costs are included in overheads, such as administrative overhead, factory overheads, or sales and distribution overhead.

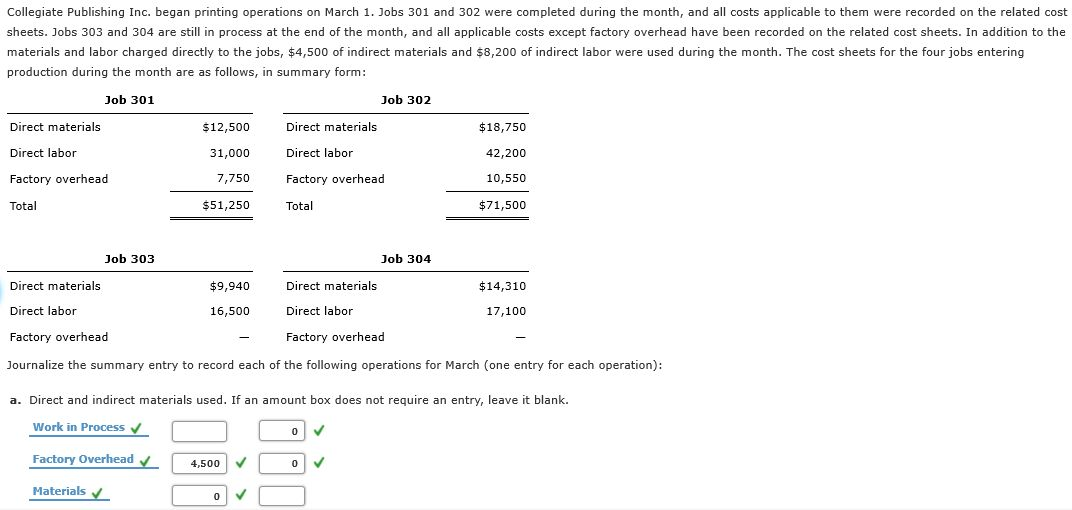

Video Illustration 2-1: Demonstrating cost flow in a job-order costing system LO2

In order to set an appropriate sales price for a product, companies need to know how much it costs to produce an item. Just as a company provides financial statement information to external stakeholders for decision-making, they must provide costing information to internal managerial decision makers. To account for these and inform managers making decisions, the costs are tracked in a cost accounting system. Before multiple predetermined manufacturing overhead rates can be computed, manufacturing overhead costs must be assigned to departments or processes.

Why would a company use job order costing instead of process costing?

Since the direct labor is regarded as purely a variable manufacturing cost, it should vary with the output volume produced by the entity. In addition, direct labor also includes product supervisors who monitor and control the assembly line activities of a specific product. Later in Part 6 we will discuss what to do with the balances in the direct labor variance accounts under the heading What To Do With Variance Amounts. Of the total amount, the company needs to account for the payroll taxes of $15,000 while the rest of $85,000 will go to the wages payable. Mostly, these costs are mainly concerned with the production process, and therefore, they are variable in nature. Varying from industry to industry, they are treated on a product basis (in a manufacturing concern), or a client basis (in the service sector).

Manufacturing Overhead

Compute the organization-wide predetermined manufacturing overhead rate using the template provided in Exhibit 2-4. Gross profit for the job is calculated as the sales revenue collected from the customer less the cost of the goods sold. In a job-order costing system, cost of goods sold represents total production costs, e.g. direct material, direct labor, and manufacturing overhead. Whatever the setting is, tracking and managing direct labor costs and rates can help management optimize the production process, keep costs low, and improve efficiency.

If demand for a product falls or the company lowers pricing, the company must cut labor costs to stay profitable. Furthermore, a corporation might do so by cutting inventory, reducing the number of employees, child tax credit definition allowing for improved productivity, or lowering specific production costs. Because Wrigley produces identical units ofproduct in batches employing a consistent process, it likely uses aprocess costing system.

Indirect Labor

For example, a tax accountant could use a job order costing system during tax season to trace costs. The one major difference between the home builder example and this one is that the tax accountant will not have direct material costs to track. Thus each job will be assigned $30 in overhead costs for every direct labor hour charged to the job. The assignment of overhead costs to jobs based on a predetermined overhead rate is called overhead applied9. Remember that overhead applied does not represent actual overhead costs incurred by the job—nor does it represent direct labor or direct material costs. Instead, overhead applied represents a portion of estimated overhead costs that is assigned to a particular job.

An organization with multiple departments or processes may choose to apply manufacturing overhead using multiple predetermined manufacturing overhead rates. All manufacturing, or product costs, that are not direct material or direct labor, are recorded in the Manufacturing Overhead account. Direct material and direct labor are applied directly to the jobs and do not flow through the Manufacturing Overhead account.

Recall from Chapter 1 that manufacturing overhead consists of all costs related to the production process other than direct materials and direct labor. Because manufacturing overhead costs are difficult to trace to specific jobs, the amount allocated to each job is based on an estimate. The process of creating this estimate requires the calculation of a predetermined rate. For example, a furniture factory classifies the cost of glue, stain, and nails as indirect materials. Nails are often used in furniture production; however, one chair may need \(15\) nails, whereas another may need 18 nails. At a cost of less than one cent per nail, it is not worth keeping track of each nail per product.

- Although it may feel like extra work you do not want to add to your staff’s plate, calculating project costs after the job is complete is a worthwhile endeavor.

- The labor rate variance is the difference between the actual labor rate paid and the standard labor rate, multiplied by the actual hours of direct labor used.

- In traditional costing systems, the most common activities used as cost drivers are direct labor in dollars, direct labor in hours, or machine hours.

- Understanding the accounting for direct labor costs is one of the key components of understanding GAAP-compliant inventory accounting.

- Indirect labor, like support roles, supervisors, quality control teams, and others without a direct contribution, should be excluded from your direct labor cost and rate calculation.

- The standard cost of direct labor and the variances for the February 2023 output is computed next.

Product costs, or inventory costs, include the costs for direct material, direct labor, and manufacturing overhead. In a job-order costing system, product costs are assigned directly to the products or jobs as they are produced or completed. In the job order costing, the labor cost of production during the period usually includes both direct labor cost and indirect labor cost. Direct labor is the total cost of wages, payroll taxes, payroll benefits, and similar expenses for the individuals who work directly on manufacturing a particular product. The direct labor costs for Dinosaur Vinyl to complete Job MAC001 occur in the production and finishing departments.

Direct labor costs are manufacturing labor costs that can be easily and economically traced to the production of the product. Indirect labor costs are manufacturing labor costs that cannot be easily and economically traced to the production of the product, e.g. the production supervisor’s salary or quality control. In addition to basic wages and salaries, an entity’s direct labor cost includes all costs and expenses needed to hire and keep direct labor workers in the organization. These costs and expenses take the form of relevant federal and state taxes, contributions and benefits provided by employers for the support and wellness of workers. Due to this reason, an entity’s total direct labor cost is often much higher than just the basic production related wages or salaries paid to workers as their remunerations. Every business has to consider labor costs (direct labor Vs indirect labor costs) while establishing contracts for its employees.

Traditional billboards with the design printed on vinyl include direct materials of vinyl and printing ink, plus the framing materials, which consist of wood and grommets. The typical billboard sign is 14 feet high by 48 feet wide, and Dinosaur Vinyl incurs a vinyl cost of $300 per billboard. The costs for all raw materials—direct and indirect—purchased to manufacture the product are debited to the Raw Materials account. The credit for raw materials costs is typically recorded in the Cash account or a related liability account.